Why AFE Leaks is different

AFEs + Actuals

Both planned and actual costs

Rapid Updates

Daily data updates, not quarterly or annual

Interactive Tools

Filter, analyze, and export in real-time

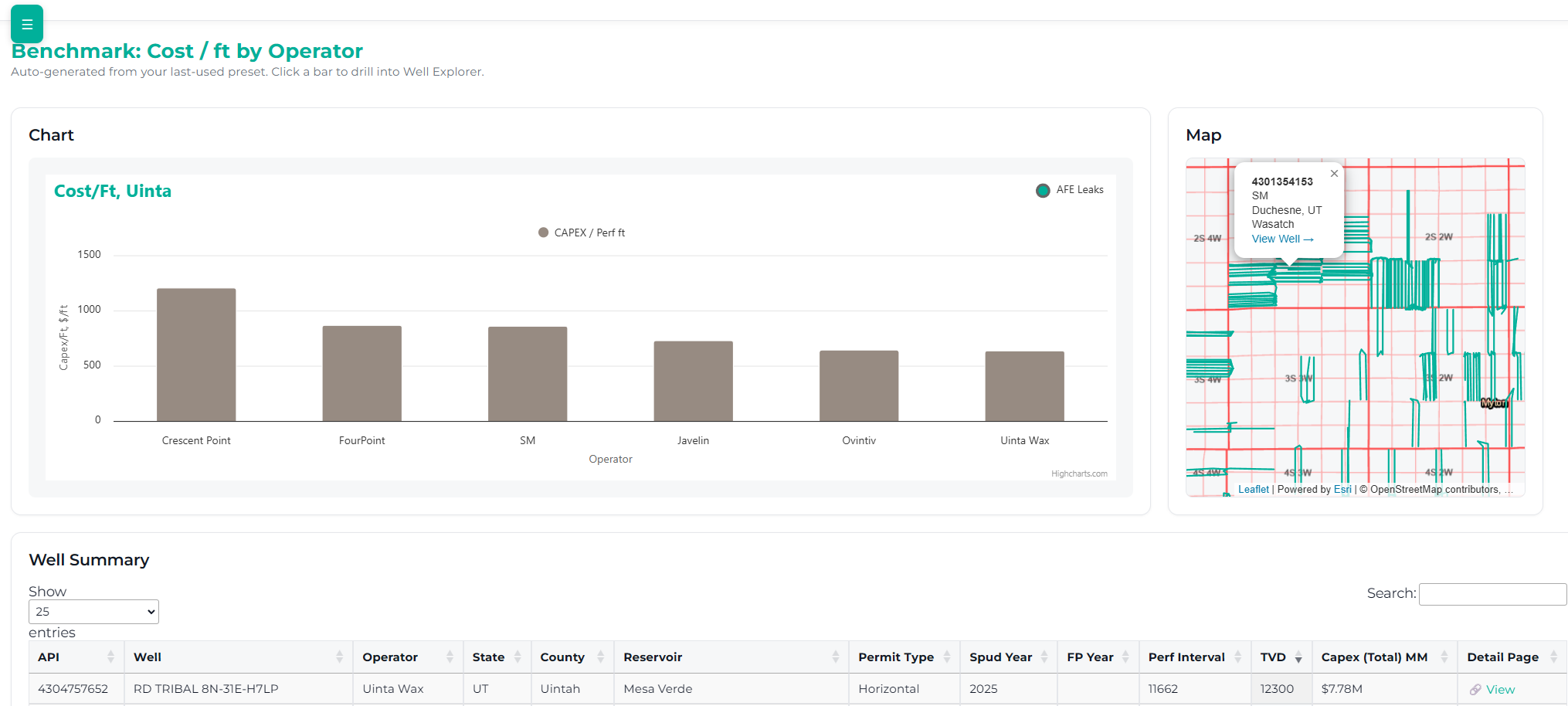

See AFE Leaks in Action

Interactive benchmarking with real-time cost comparisons and detailed analytics