Q2 2025 Oil Hedge Look

Earnings are coming and prices are crashing; let's see what the impact is to cash flow in Q2

There’s always been a bit of optimism baked into how O&G folks view oil prices — we tend to assume they’ll rise. The alternative isn’t something we like to think about.

Unless over-levered, operators used to be a bit hesitant to layer on too many oil hedges.

Unless they were over-levered, operators used to be hesitant to layer on too many oil hedges. But the last decade of price swings has changed that mindset. These days, many teams hedge a decent chunk of volumes just to protect drilling plans — especially with how expensive it is to break a rig contract or miss lease obligations tied to continuous drilling.

So, in honor of the beating we’ve all taken with this past week’s oil-price selloff, here’s a quick look at total oil hedges in Q2 ahead of earnings.

Note: Hedges/Guidance are based on latest 10-K, so anything added in Q1 isn’t reflected yet.

WTI Prices have taken a dive post-tariffs

Operators have a good bit of protection as a percent of Q2 expected volumes

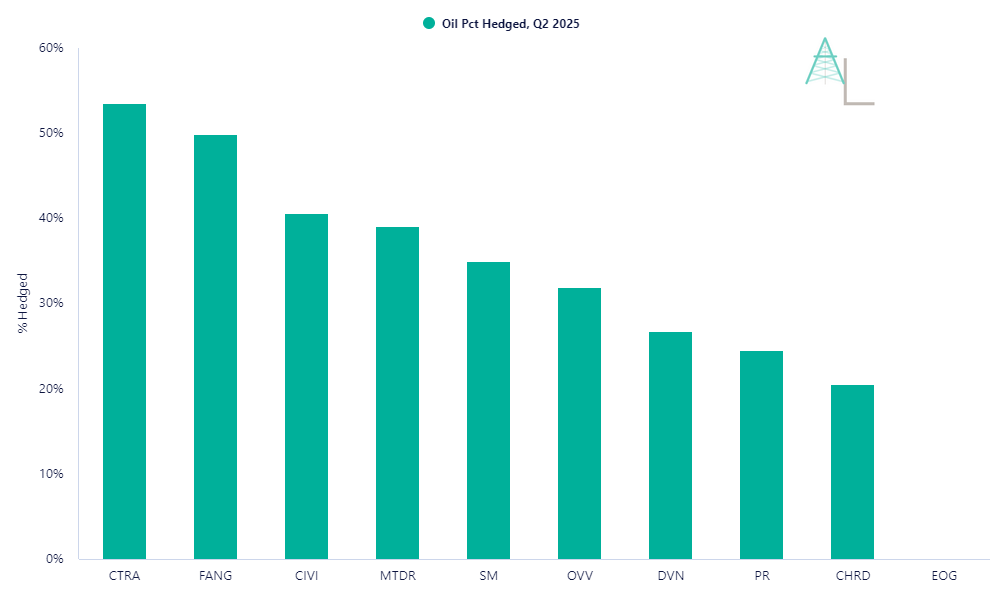

Many operators are fairly well protected for Q2, at least relative to expected production volumes.

From a guidance standpoint, most of the oil-heavy names are above the 25% hedged threshold. FANG and CTRA are closer to the 50% mark (Roll Swaps and Basis Diffs are excluded here). Meanwhile, EOG is currently rolling with zero oil hedges.

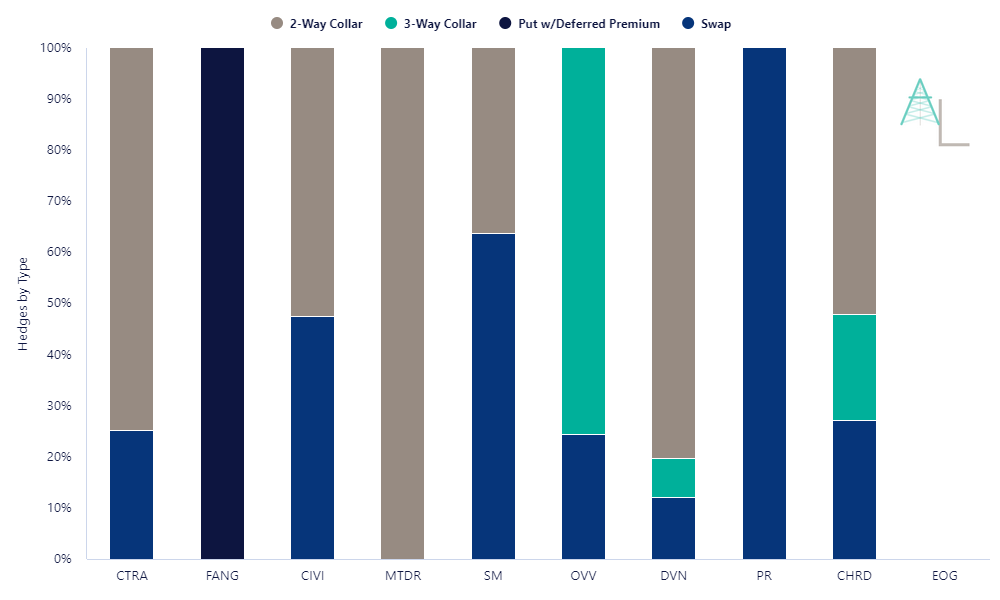

Two-Way Collars are the instrument of choice, followed by Swaps and Three-Ways

FANG stands out — they’ve got good downside protection and upside participation (thanks to Put-based structures).

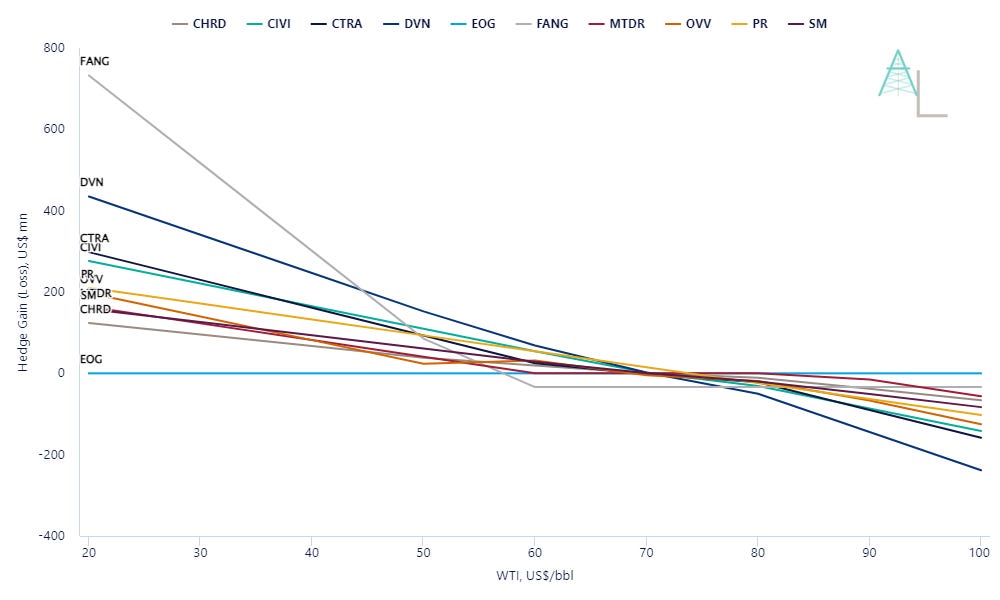

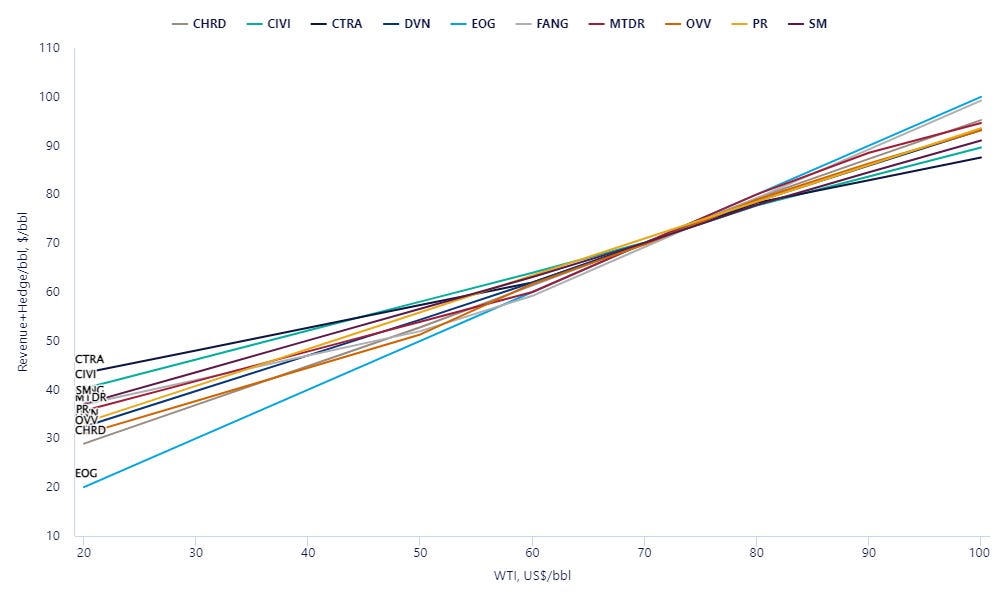

But when we flip the view to average price realized (Oil Revenue + Hedge Gain/Loss), the story shifts.

Coterra and Civitas, both 2-Way Collar fans, show the most downside price support. But they also cap out on the upside. EOG, with no hedges, sees the widest spread between low and high price outcomes. Which is expected behavior after all; the point of hedging is to provide downside protection at the expense of upside.

Given the current geopolitical volatility, the unhedged bet may not have been the right one.

👀 I’m curious to see what comes out in Q1 earnings.

Historically, management teams often reactively hedge after a selloff — not before — which isn’t exactly ideal.

Regardless, keep that bit turning folks.