This insight is a weekly roundup of activity from the Baker Hughes Rig Report, current prices/futures, and news.

AFE Leaks Updates

The AFE Leaks API is now live — bring real-world well cost data for our now 93,000+ wells directly into your tools like Power BI or Excel.

✅ Instantly pull Actual and AFE costs

✅ Full cost breakdowns by component

✅ Well-level data: completions, casing/tubing, formations, production, locations, and more

✅ Updated regularly — ready for your internal workflows

📬 Reach out at bd@afeleaks.com to get started or discuss a license.

🔁 Not ready for a full API subscription? I also offer custom downloads — choose a specific set of wells (by operator, basin, or date range) and get a one-time export with full cost and well details. Perfect for analysts doing one-off evaluations, bid decks, or internal benchmarking.

Progressing through a sample Power BI to showcase the API and capabilities. Expect to drop within the next week. Will focus on similar excel version after.

Converted 100’s of New Mexico AFE’s to full cost breakdowns.

Next paid research report will focus on U-turns, assuming I can get enough sample size. Currently focusing on two developments in Reeves county by Chevron, but feel free to shoot me any other developments that I can look into.

Began integrating Utah and Colorado workflows into database which should be available within the next couple of weeks. Utah data typically contains a combination of both AFE and Actual costs for each development, with breakdowns of each. Colorado is AFE-level, but the data-set is large and very current. North Dakota is next on the list.

Working through supplier-level cost dataset. Would like to get enough scale before adding to the product list, but it is progressing.

Activity Update

Activity Update

Rumors, or maybe just speculation, emerged that BP may be a takeover target for an even larger major. Chances? 0%? Less than 0? Probably not far off, but activist Elliot has built a 5% stake so we’ll see how annoying they can be in order to institute change. The pivot back towards oil and gas after pushing renewables the last decade probably does not instill much confidence that current management is up to the task of running this behemoth optimally. The other major issue is trying to operate a commodities’ business from a jurisdiction that hates you, as many who have operated in California could attest.

BP share price has lagged well behind peers over the last half-decade (indexed at 1)

Tariff tantrum has claimed its first victim, with Camino pulling their Midcon sale. I would expect other deals — like the planned VTX sales process — to be tabled for a bit as well. M&A and uncertain fiscal environments? Bad mix.

Prices

Oil prices began recovering a bit, which typically occurs after knee-jerk reactions. Henry Hub did what it does best — go lower (down ~$1 in the last two weeks).

Rigs

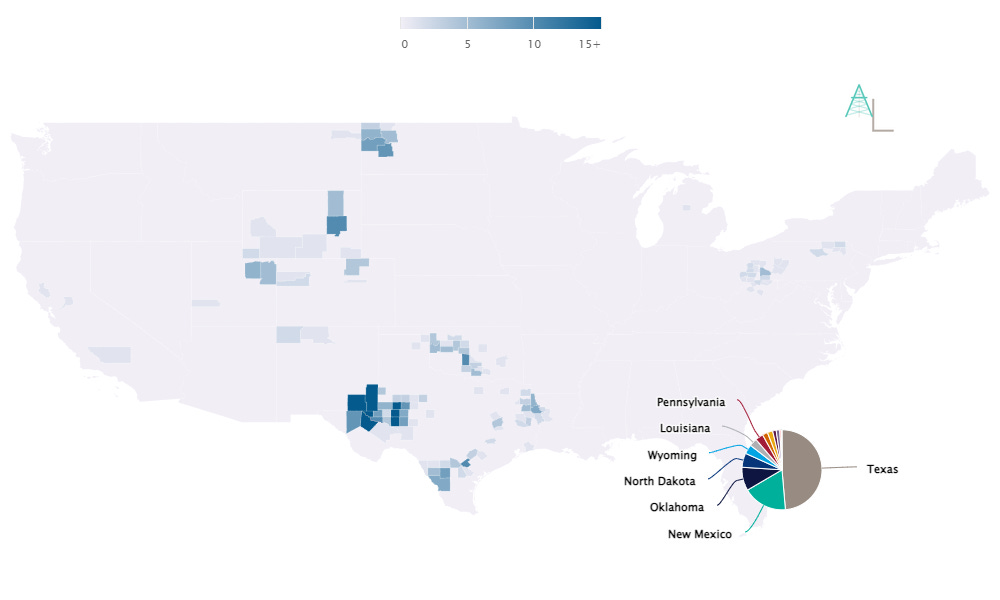

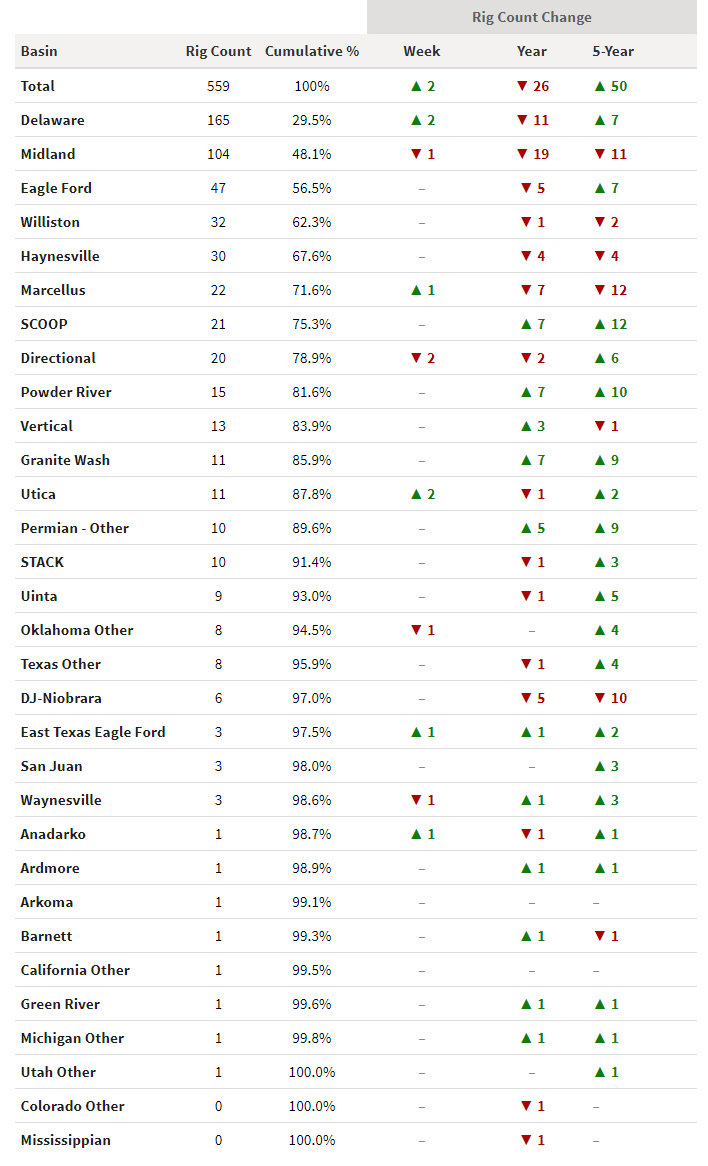

Texas, and particularly the Permian, dominates the rig count. Add in the bordering states, and this broader region represents roughly ~80% of L48 rigs.

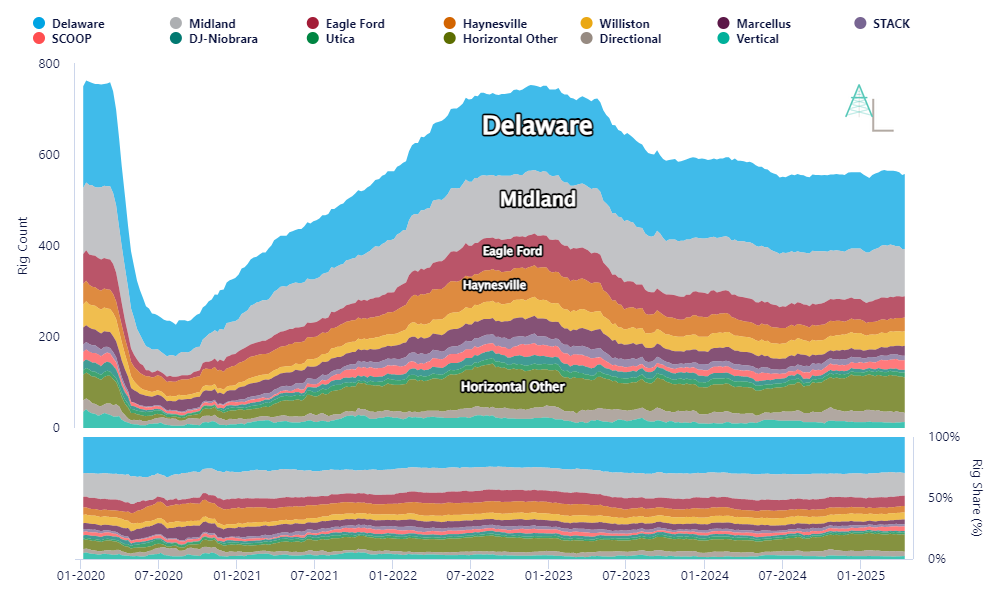

Rig counts actually moved up this week by 2, perhaps defying expectations. Though, as we pointed out last week, rig counts lag price due to things like current drilling, rig contracts, and hedges (which are a financial product disconnected from your operations but don’t tell that to a driller!).

Permian gained a net 1 to maintain their roughly 50% share, though the continuing Midland drop is interesting.

Well Highlight of the Week

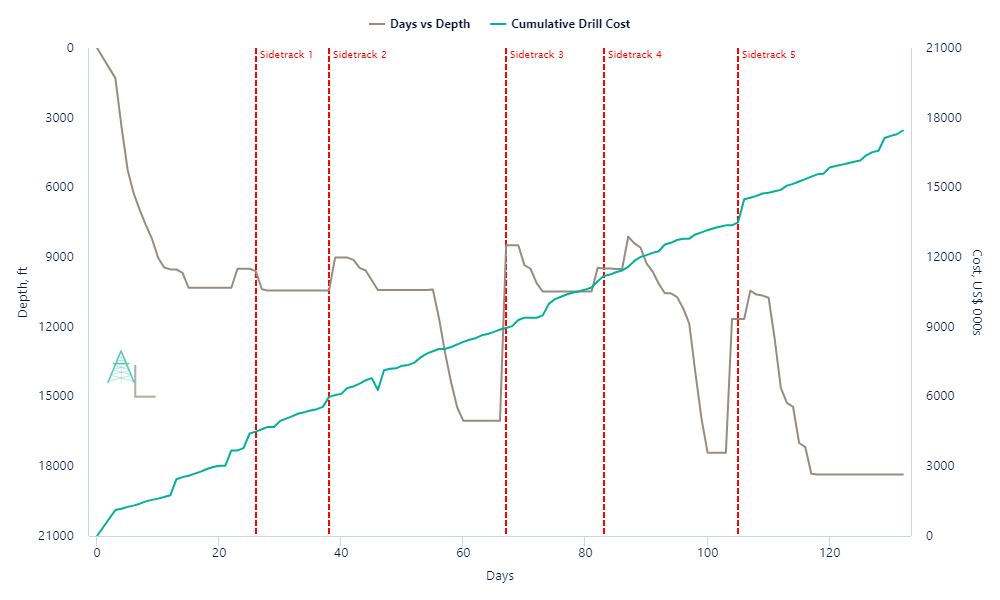

Today’s well is BTA’s UL Lonetree 22303 A 23-26 #5H, a Barnett well being drilled down in Crane. No production data is in yet, as it took roughly 6 months to release the rig after spending $17,499,700 on drilling this thing. While I don’t know for sure, conjecture on X indicates this bad boy tried to make the turn in the Barnett, which is not good. Five sidetracks, parted motors, stuck liners; this one was a mess. Every time I read the word ream it hurt my heart a little. To add insult to injury, the pipe got stuck after TD while back-reaming out, and they spent a week fishing it, which was somehow successful. Then, the production casing got stuck ~1500 ft above TD while RIH, which is where they made the call to end it. Still waiting on completion cost to come through, but it’s a rough one.

UL Lonetree 22303 A 23-26 #5H ~$17.5 Million Drill Cost for a 6,488 ft lateral.

That’s it for this one! If you enjoy this content, subscribe already!